- Get link

- X

- Other Apps

You should go with whatever works harmoniously as a couple in your family. Notify your Human Resources contact and have them update your deposits.

Joint Bank Accounts What Do Women Think Self

Joint Bank Accounts What Do Women Think Self

Joining bank accounts after getting married could be the right choice for you and your other half.

Joining bank accounts after marriage. Youll want that money moving to the joint accounts and if you havent already go ahead and have automatic transfers made into savings. Joint finances mean something different for every couple. Visit Your Bank.

They may have advice that is very useful to your situation and maybe youll learn something important that your bank does for newlyweds or of an app or special service your bank has for married couples. Some newlyweds open a joint account while at the same time keeping individual accounts for things like personal purchases and pre-existing debts. Maybe its neither it really could be anything in between.

A subject of perennial debate among our audience I recommend couples merge bank accounts after marriage. Decide whose accounts to close if you and your spouse use different banks. This best-of-both-worlds strategy can make it easier to keep track of shared bills or other family expenses and it helps couples retain some of their financial independence.

Often it is simply signing a new person onto one account and closing. When you do it is up to you. When you share the same bank accounts agree on a budget and review each others transactions youll know where youre both headed financially which will give you a greater sense of security.

But before you open a joint bank account together make sure youre both taking a collaborative approach to your finances as well. Once you have a plan on which accounts you want to merge and which ones you want to close visit your respective banks. Or it could be best that the accounts remain separate indefinitely.

Assuming you do you banking at a brick-and-mortar bank talk to your bank teller and ask if he or she has any advicerecommendations on joint bank accounts. Simply go to the bank and tell them you want to change the names on the account. Most banks dont require you to provide a marriage certificate to set up a joint account.

Money is an aspect of married life we should discuss in a healthy open-minded manner. For couples who live together before marriage deciding when to combine finances might happen organically or out of necessity. Some couples keep their money mostly separate and only share one or two bank accounts.

Youll get a cash or check payout from the closed accounts so take the funds to a branch of the bank where the combined accounts will be. It often doesnt work when newlyweds add money to their personal bank accounts first then put the remaining cash in the joint account Edelman says. Your banker may also have suggestions on new accounts that may be better designed for a joint account.

The first step in any financial plan whether youre single or married is to create a plan that will fit your lifestyle. The benefits of joint accounts are administrative ease lower costs its easier to manage simpler to. Theyll walk you through the entire process and begin the merging process.

Other couples combine everythingbank accounts credit cards investments accounts and more. Money issues can tear a marriage apart if you dont have consistent goals and values. If desired you can then have separate accounts andor credit cards that you use for small discretionary purchases or gifts for your partner.

The spouse joining the existing account will need to show ID to be added and then they can deposit their funds. Lots of people bristle at the idea of joining accounts but heres why its a good idea. When it comes to combining finances there isnt a.

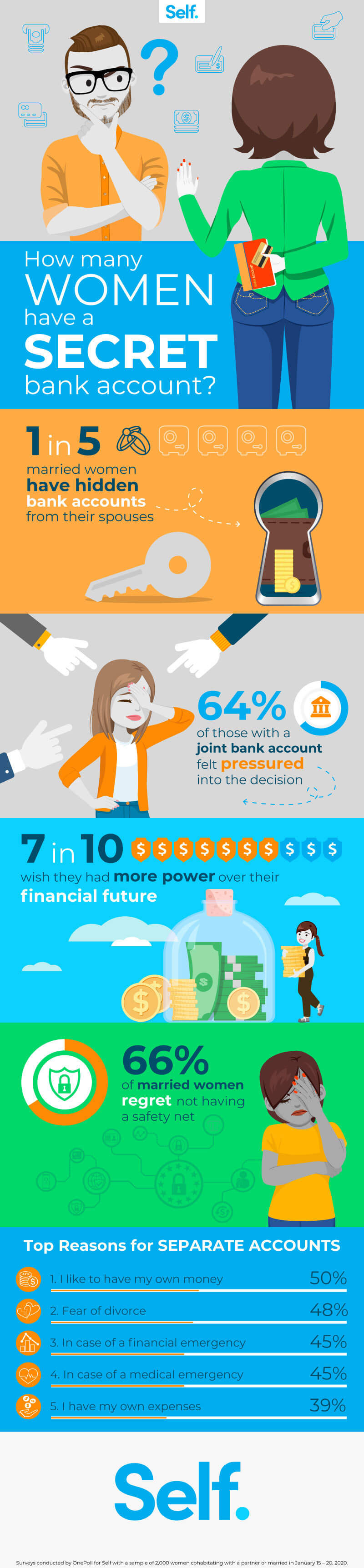

Trust is a vital element in any marriage. Lauren Anastasio a certified financial planner with SoFi says theres no right or wrong time to consider opening a joint bank account or taking out a new credit card together. Thirty-five percent of couples say that a secret bank account is the equivalent of cheating on a partner or spouse while 20 say that its worse.

You may find that a local credit union or community bank offers the service you prefer without the needless fees. As a result they start living paycheck to paycheck and not have any money saved. There shouldnt be any hard rule on whether to join accounts after marriage or not.

The problems that most couples will have tend to happen at the beginning because they are unsure on what they want to save their money for. One major drawback to sharing a joint bank account is that it can cause issues in a marriage when spouses arent communicating about their account activity or worse keeping financial secrets. Unless you can agree with your spouse ahead of time to distribute funds held in joint bank accounts equitably and cancel or transfer jointly held credit cards the prospect of which is unlikely in an acrimonious environment the responsibility for doing so falls to a judge or mediator.

Without trust marriages cannot last.

:max_bytes(150000):strip_icc()/financial-advice-for-married-couples-9c186326c6894f16ab8bdfd418d2e58f.png) Financial Advice Married Couples Should Not Ignore

Financial Advice Married Couples Should Not Ignore

/should-you-have-joint-or-separate-bank-accounts-1289664-final-5bd08bd946e0fb0026ee9838-5bec6d0bc9e77c0051fcd280.png) Should Couples Have Joint Or Separate Bank Accounts

Should Couples Have Joint Or Separate Bank Accounts

Should You And Your Spouse Have A Joint Account Or Separate Bank Accounts I Am Grenadian

Should Married Couples Have Joint Or Separate Bank Accounts

Should Married Couples Have Joint Or Separate Bank Accounts

Important For Married Couple To Have Joint Bank Account Heartland Boy

Important For Married Couple To Have Joint Bank Account Heartland Boy

Should You Opt For A Joint Bank Account After Marriage Tmgth Joint Savings Account Bank Account Accounting

Should You Opt For A Joint Bank Account After Marriage Tmgth Joint Savings Account Bank Account Accounting

Opening A Joint Bank Account Merging Finances After Marriage Pros Cons

Opening A Joint Bank Account Merging Finances After Marriage Pros Cons

Should Married Couples Have Joint Or Separate Bank Accounts

Should Married Couples Have Joint Or Separate Bank Accounts

/should-you-have-joint-or-separate-bank-accounts-1289664-final-5bd08bd946e0fb0026ee9838-5bec6d0bc9e77c0051fcd280.png) Should Couples Have Joint Or Separate Bank Accounts

Should Couples Have Joint Or Separate Bank Accounts

Should Married Couples Have Joint Or Separate Accounts Joint Savings Account Accounting Married Couple

Should Married Couples Have Joint Or Separate Accounts Joint Savings Account Accounting Married Couple

6 Financial Conversations You Must Have Before Getting Married Savvywomen Tomorrowmakers

6 Financial Conversations You Must Have Before Getting Married Savvywomen Tomorrowmakers

Pros And Cons A Joint Bank Account After The Wedding

Pros And Cons A Joint Bank Account After The Wedding

How To Merge Bank Accounts After Marriage Money Under 30

How To Merge Bank Accounts After Marriage Money Under 30

Comments

Post a Comment